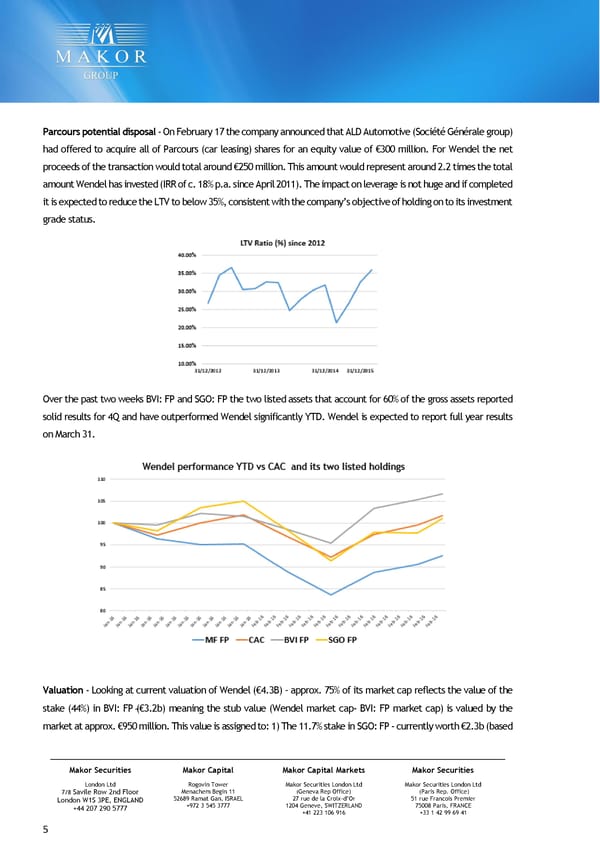

MAKOR FLASH-LIGHT Aug 12, 2015 Parcours potential disposal - On February 17 the company announced that ALD Automotive (Société Générale group) had offered to acquire all of Parcours (car leasing) shares for an equity value of €300 million. For Wendel the net proceeds of the transaction would total around €250 million. This amount would represent around 2.2 times the total amount Wendel has invested (IRR of c. 18% p.a. since April 2011). The impact on leverage is not huge and if completed it is expected to reduce the LTV to below 35%, consistent with the company’s objective of holding on to its investment grade status. Over the past two weeks BVI: FP and SGO: FP the two listed assets that account for 60% of the gross assets reported solid results for 4Q and have outperformed Wendel significantly YTD. Wendel is expected to report full year results on March 31. Valuation - Looking at current valuation of Wendel (€4.3B) – approx. 75% of its market cap reflects the value of the stake (44%) in BVI: FP (̴€3.2b) meaning the stub value (Wendel market cap- BVI: FP market cap) is valued by the market at approx. €950 million. This value is assigned to: 1) The 11.7% stake in SGO: FP - currently worth €2.3b (based Makor Securities Makor Capital Makor Capital Markets Makor Securities London Ltd Rogovin Tower Makor Securities London Ltd Makor Securities London Ltd 7/8 Savile Row 2nd Floor Menachem Begin 11 (Geneva Rep Office) (Paris Rep. Office) London W1S 3PE, ENGLAND 52689 Ramat Gan, ISRAEL 27 rue de la Croix-d’Or 51 rue Francois Premier +44 207 290 5777 +972 3 545 3777 1204 Geneve, SWITZERLAND 75008 Paris, FRANCE +41 223 106 916 +33 1 42 99 69 41 5

Long MF FP & Short BVI FP+SGO FP Page 4 Page 6

Long MF FP & Short BVI FP+SGO FP Page 4 Page 6