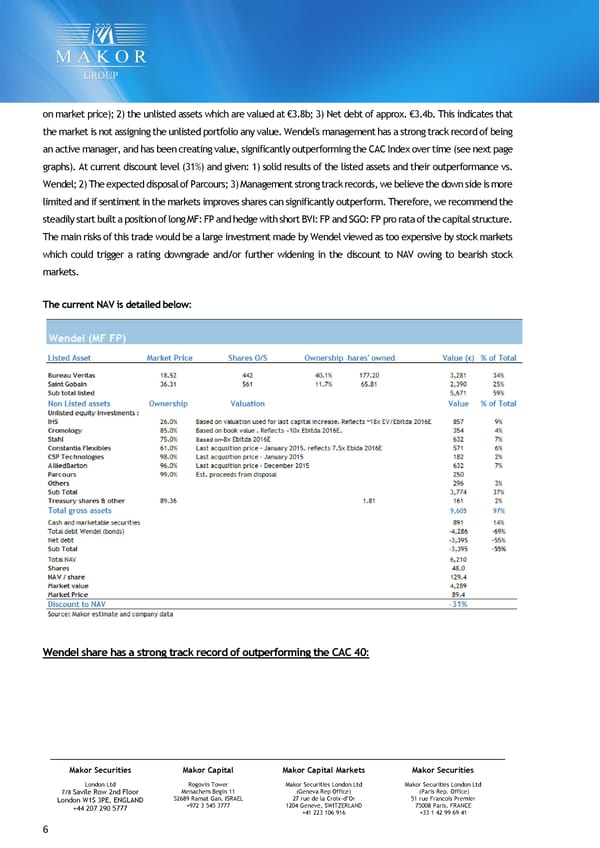

MAKOR FLASH-LIGHT Aug 12, 2015 on market price); 2) the unlisted assets which are valued at €3.8b; 3) Net debt of approx. €3.4b. This indicates that the market is not assigning the unlisted portfolio any value. Wendel's management has a strong track record of being an active manager, and has been creating value, significantly outperforming the CAC Index over time (see next page graphs). At current discount level (31%) and given: 1) solid results of the listed assets and their outperformance vs. Wendel; 2) The expected disposal of Parcours; 3) Management strong track records, we believe the down side is more limited and if sentiment in the markets improves shares can significantly outperform. Therefore, we recommend the steadily start built a position of long MF: FP and hedge with short BVI: FP and SGO: FP pro rata of the capital structure. The main risks of this trade would be a large investment made by Wendel viewed as too expensive by stock markets which could trigger a rating downgrade and/or further widening in the discount to NAV owing to bearish stock markets. The current NAV is detailed below: Wendel share has a strong track record of outperforming the CAC 40: Makor Securities Makor Capital Makor Capital Markets Makor Securities London Ltd Rogovin Tower Makor Securities London Ltd Makor Securities London Ltd 7/8 Savile Row 2nd Floor Menachem Begin 11 (Geneva Rep Office) (Paris Rep. Office) London W1S 3PE, ENGLAND 52689 Ramat Gan, ISRAEL 27 rue de la Croix-d’Or 51 rue Francois Premier +44 207 290 5777 +972 3 545 3777 1204 Geneve, SWITZERLAND 75008 Paris, FRANCE +41 223 106 916 +33 1 42 99 69 41 6

Long MF FP & Short BVI FP+SGO FP Page 5 Page 7

Long MF FP & Short BVI FP+SGO FP Page 5 Page 7