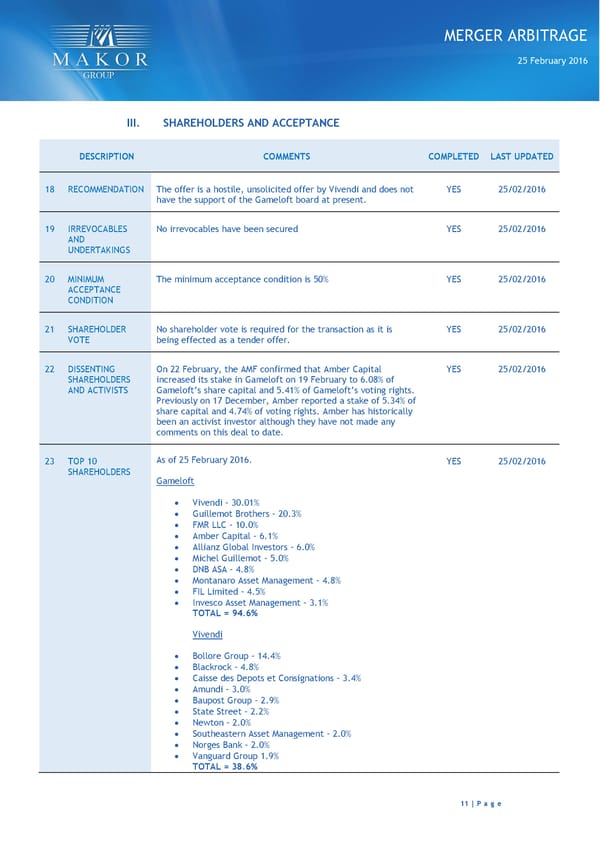

MERGER ARBITRAGE 25 February 2016 III. SHAREHOLDERS AND ACCEPTANCE DESCRIPTION COMMENTS COMPLETED LAST UPDATED 18 RECOMMENDATION The offer is a hostile, unsolicited offer by Vivendi and does not YES 25/02/2016 have the support of the Gameloft board at present. 19 IRREVOCABLES No irrevocables have been secured YES 25/02/2016 AND UNDERTAKINGS 20 MINIMUM The minimum acceptance condition is 50% YES 25/02/2016 ACCEPTANCE CONDITION 21 SHAREHOLDER No shareholder vote is required for the transaction as it is YES 25/02/2016 VOTE being effected as a tender offer. 22 DISSENTING On 22 February, the AMF confirmed that Amber Capital YES 25/02/2016 SHAREHOLDERS increased its stake in Gameloft on 19 February to 6.08% of AND ACTIVISTS Gameloft’s share capital and 5.41% of Gameloft’s voting rights. Previously on 17 December, Amber reported a stake of 5.34% of share capital and 4.74% of voting rights. Amber has historically been an activist investor although they have not made any comments on this deal to date. 23 TOP 10 As of 25 February 2016. YES 25/02/2016 SHAREHOLDERS Gameloft Vivendi – 30.01% Guillemot Brothers – 20.3% FMR LLC – 10.0% Amber Capital – 6.1% Allianz Global Investors – 6.0% Michel Guillemot – 5.0% DNB ASA – 4.8% Montanaro Asset Management – 4.8% FIL Limited – 4.5% Invesco Asset Management – 3.1% TOTAL = 94.6% Vivendi Bollore Group – 14.4% Blackrock – 4.8% Caisse des Depots et Consignations – 3.4% Amundi – 3.0% Baupost Group – 2.9% State Street – 2.2% Newton – 2.0% Southeastern Asset Management – 2.0% Norges Bank – 2.0% Vanguard Group 1.9% TOTAL = 38.6% 11 | P a g e

Gameloft (GFT FP) Page 10 Page 12

Gameloft (GFT FP) Page 10 Page 12