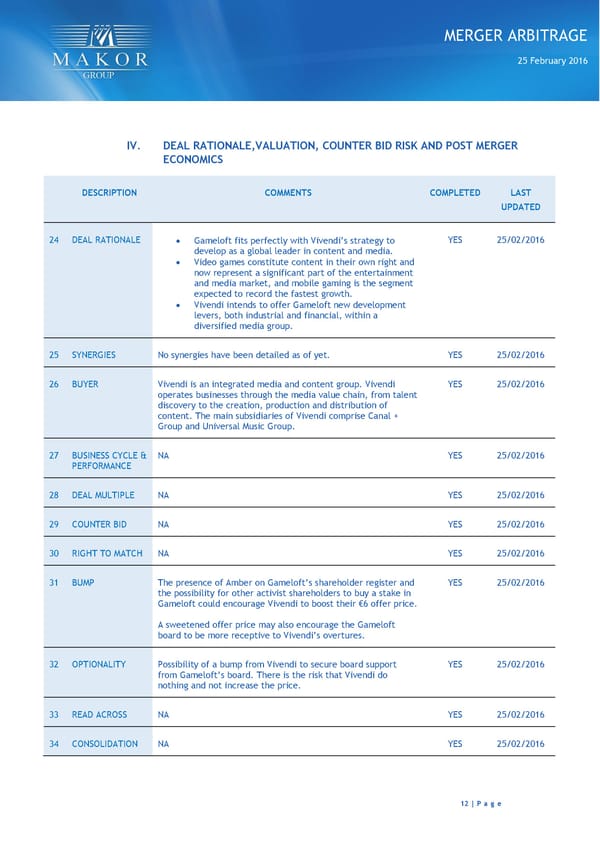

MERGER ARBITRAGE 25 February 2016 IV. DEAL RATIONALE,VALUATION, COUNTER BID RISK AND POST MERGER ECONOMICS DESCRIPTION COMMENTS COMPLETED LAST UPDATED 24 DEAL RATIONALE Gameloft fits perfectly with Vivendi’s strategy to YES 25/02/2016 develop as a global leader in content and media. Video games constitute content in their own right and now represent a significant part of the entertainment and media market, and mobile gaming is the segment expected to record the fastest growth. Vivendi intends to offer Gameloft new development levers, both industrial and financial, within a diversified media group. 25 SYNERGIES No synergies have been detailed as of yet. YES 25/02/2016 26 BUYER Vivendi is an integrated media and content group. Vivendi YES 25/02/2016 operates businesses through the media value chain, from talent discovery to the creation, production and distribution of content. The main subsidiaries of Vivendi comprise Canal + Group and Universal Music Group. 27 BUSINESS CYCLE & NA YES 25/02/2016 PERFORMANCE 28 DEAL MULTIPLE NA YES 25/02/2016 29 COUNTER BID NA YES 25/02/2016 30 RIGHT TO MATCH NA YES 25/02/2016 31 BUMP The presence of Amber on Gameloft’s shareholder register and YES 25/02/2016 the possibility for other activist shareholders to buy a stake in Gameloft could encourage Vivendi to boost their €6 offer price. A sweetened offer price may also encourage the Gameloft board to be more receptive to Vivendi’s overtures. 32 OPTIONALITY Possibility of a bump from Vivendi to secure board support YES 25/02/2016 from Gameloft’s board. There is the risk that Vivendi do nothing and not increase the price. 33 READ ACROSS NA YES 25/02/2016 34 CONSOLIDATION NA YES 25/02/2016 12 | P a g e

Gameloft (GFT FP) Page 11 Page 13

Gameloft (GFT FP) Page 11 Page 13