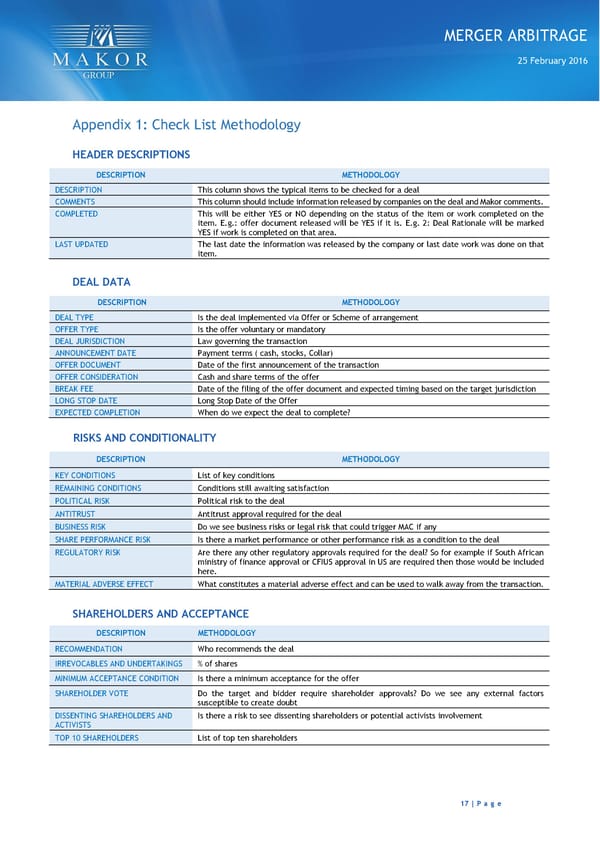

MERGER ARBITRAGE 25 February 2016 Appendix 1: Check List Methodology HEADER DESCRIPTIONS DESCRIPTION METHODOLOGY DESCRIPTION This column shows the typical items to be checked for a deal COMMENTS This column should include information released by companies on the deal and Makor comments. COMPLETED This will be either YES or NO depending on the status of the item or work completed on the item. E.g.: offer document released will be YES if it is. E.g. 2: Deal Rationale will be marked YES if work is completed on that area. LAST UPDATED The last date the information was released by the company or last date work was done on that item. DEAL DATA DESCRIPTION METHODOLOGY DEAL TYPE Is the deal implemented via Offer or Scheme of arrangement OFFER TYPE Is the offer voluntary or mandatory DEAL JURISDICTION Law governing the transaction ANNOUNCEMENT DATE Payment terms ( cash, stocks, Collar) OFFER DOCUMENT Date of the first announcement of the transaction OFFER CONSIDERATION Cash and share terms of the offer BREAK FEE Date of the filing of the offer document and expected timing based on the target jurisdiction LONG STOP DATE Long Stop Date of the Offer EXPECTED COMPLETION When do we expect the deal to complete? RISKS AND CONDITIONALITY DESCRIPTION METHODOLOGY KEY CONDITIONS List of key conditions REMAINING CONDITIONS Conditions still awaiting satisfaction POLITICAL RISK Political risk to the deal ANTITRUST Antitrust approval required for the deal BUSINESS RISK Do we see business risks or legal risk that could trigger MAC if any SHARE PERFORMANCE RISK Is there a market performance or other performance risk as a condition to the deal REGULATORY RISK Are there any other regulatory approvals required for the deal? So for example if South African ministry of finance approval or CFIUS approval in US are required then those would be included here. MATERIAL ADVERSE EFFECT What constitutes a material adverse effect and can be used to walk away from the transaction. SHAREHOLDERS AND ACCEPTANCE DESCRIPTION METHODOLOGY RECOMMENDATION Who recommends the deal IRREVOCABLES AND UNDERTAKINGS % of shares MINIMUM ACCEPTANCE CONDITION Is there a minimum acceptance for the offer SHAREHOLDER VOTE Do the target and bidder require shareholder approvals? Do we see any external factors susceptible to create doubt DISSENTING SHAREHOLDERS AND Is there a risk to see dissenting shareholders or potential activists involvement ACTIVISTS TOP 10 SHAREHOLDERS List of top ten shareholders 17 | P a g e

Gameloft (GFT FP) Page 16 Page 18

Gameloft (GFT FP) Page 16 Page 18