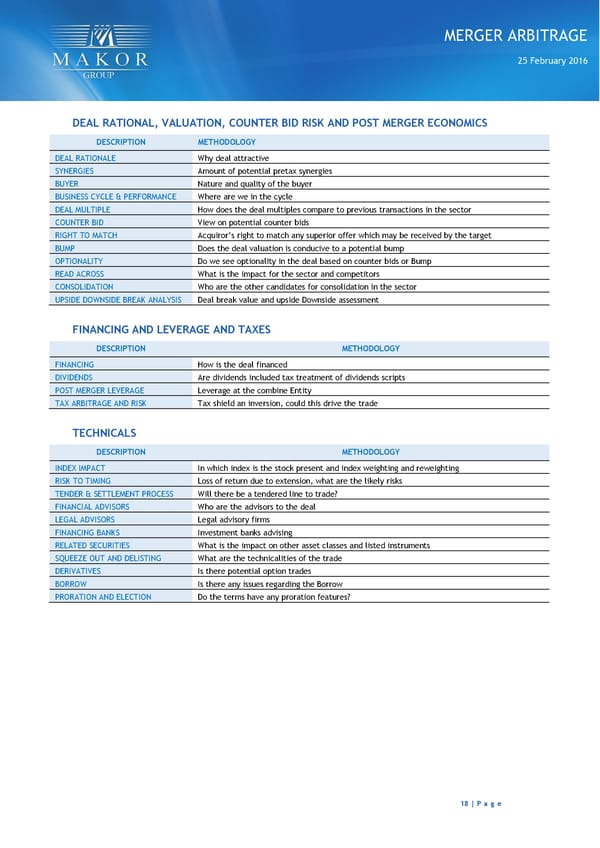

MERGER ARBITRAGE 25 February 2016 DEAL RATIONAL, VALUATION, COUNTER BID RISK AND POST MERGER ECONOMICS DESCRIPTION METHODOLOGY DEAL RATIONALE Why deal attractive SYNERGIES Amount of potential pretax synergies BUYER Nature and quality of the buyer BUSINESS CYCLE & PERFORMANCE Where are we in the cycle DEAL MULTIPLE How does the deal multiples compare to previous transactions in the sector COUNTER BID View on potential counter bids RIGHT TO MATCH Acquiror’s right to match any superior offer which may be received by the target BUMP Does the deal valuation is conducive to a potential bump OPTIONALITY Do we see optionality in the deal based on counter bids or Bump READ ACROSS What is the impact for the sector and competitors CONSOLIDATION Who are the other candidates for consolidation in the sector UPSIDE DOWNSIDE BREAK ANALYSIS Deal break value and upside Downside assessment FINANCING AND LEVERAGE AND TAXES DESCRIPTION METHODOLOGY FINANCING How is the deal financed DIVIDENDS Are dividends included tax treatment of dividends scripts POST MERGER LEVERAGE Leverage at the combine Entity TAX ARBITRAGE AND RISK Tax shield an inversion, could this drive the trade TECHNICALS DESCRIPTION METHODOLOGY INDEX IMPACT In which index is the stock present and index weighting and reweighting RISK TO TIMING Loss of return due to extension, what are the likely risks TENDER & SETTLEMENT PROCESS Will there be a tendered line to trade? FINANCIAL ADVISORS Who are the advisors to the deal LEGAL ADVISORS Legal advisory firms FINANCING BANKS Investment banks advising RELATED SECURITIES What is the impact on other asset classes and listed instruments SQUEEZE OUT AND DELISTING What are the technicalities of the trade DERIVATIVES Is there potential option trades BORROW Is there any issues regarding the Borrow PRORATION AND ELECTION Do the terms have any proration features? 18 | P a g e

Gameloft (GFT FP) Page 17 Page 19

Gameloft (GFT FP) Page 17 Page 19