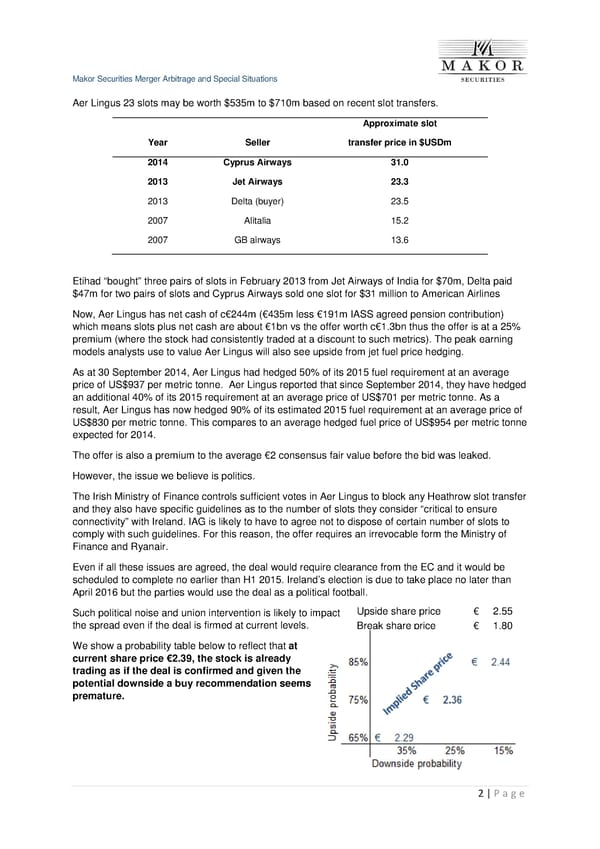

Makor Securities Merger Arbitrage and Special Situations 2 | P a g e Aer Lingus 23 slots may be worth $535m to $710m based on recent slot transfers. Year Seller Approximate slot transfer price in $USDm 2014 Cyprus Airways 31.0 2013 Jet Airways 23.3 2013 Delta (buyer) 23.5 2007 Alitalia 15.2 2007 GB airways 13.6 Etihad “bought” three pairs of slots in February 2013 from Jet Airways of India for $70m, Delta paid $47m for two pairs of slots and Cyprus Airways sold one slot for $31 million to American Airlines Now, Aer Lingus has net cash of c€244m (€435m less €191m IASS agreed pension contribution) which means slots plus net cash are about €1bn vs t he offer worth c€1.3bn thus the offer is at a 25% premium (where the stock had consistently traded at a discount to such metrics). The peak earning models analysts use to value Aer Lingus will also s ee upside from jet fuel price hedging. As at 30 September 2014, Aer Lingus had hedged 50% of its 2015 fuel requirement at an average price of US$937 per metric tonne. Aer Lingus repor ted that since September 2014, they have hedged an additional 40% of its 2015 requirement at an ave rage price of US$701 per metric tonne. As a result, Aer Lingus has now hedged 90% of its estima ted 2015 fuel requirement at an average price of US$830 per metric tonne. This compares to an averag e hedged fuel price of US$954 per metric tonne expected for 2014. The offer is also a premium to the average €2 conse nsus fair value before the bid was leaked. However, the issue we believe is politics. The Irish Ministry of Finance controls sufficient v otes in Aer Lingus to block any Heathrow slot trans fer and they also have specific guidelines as to the nu mber of slots they consider “critical to ensure connectivity” with Ireland. IAG is likely to have t o agree not to dispose of certain number of slots t o comply with such guidelines. For this reason, the o ffer requires an irrevocable form the Ministry of Finance and Ryanair. Even if all these issues are agreed, the deal would require clearance from the EC and it would be scheduled to complete no earlier than H1 2015. Irel and’s election is due to take place no later than April 2016 but the parties would use the deal as a political football. Such political noise and union intervention is like ly to impact the spread even if the deal is firmed at current le vels. We show a probability table below to reflect that at current share price €2.39, the stock is already trading as if the deal is confirmed and given the potential downside a buy recommendation seems premature. Upside share price € 2.55 Break share price € 1.80

Aer Lingus Takeover Page 16 Page 18

Aer Lingus Takeover Page 16 Page 18