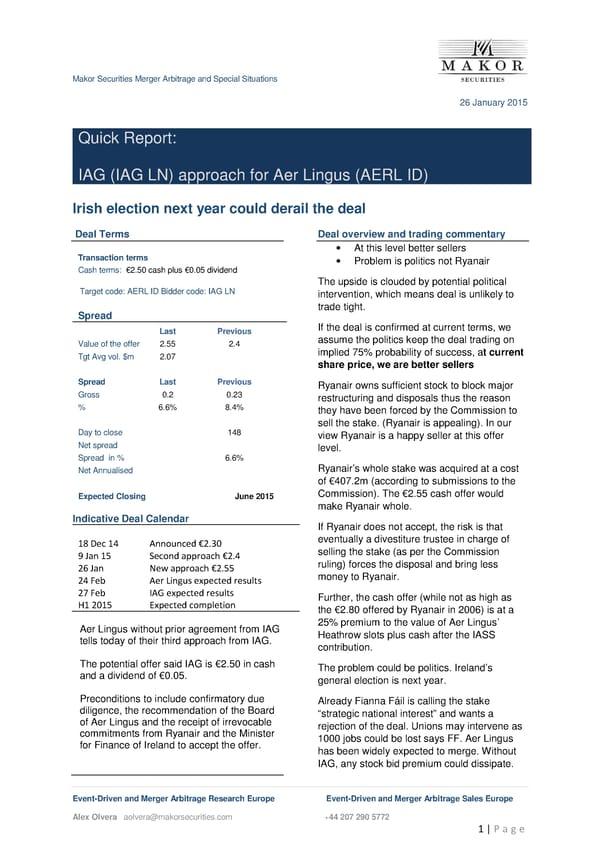

Makor Securities Merger Arbitrage and Special Situations Event-Driven and Merger Arbitrage Research Europe Event-Driven and Merger Arbitrage Sales Europe Alex Olvera aolvera@makorsecurities.com +44 207 290 5772 1 | P a g e 26 January 2015 Quick Report: IAG (IAG LN) approach for Aer Lingus (AERL ID) Irish election next year could derail the deal Deal Terms Transaction terms Cash terms: €2.50 cash plus €0.05 dividend Target code: AERL ID Bidder code: IAG LN Spread Last Previous Value of the offer 2.55 2.4 Tgt Avg vol. $m 2.07 Spread Last Previous Gross 0.2 0.23 % 6.6% 8.4% Day to close 148 Net spread Spread in % 6.6% Net Annualised Expected Closing June 2015 Indicative Deal Calendar 18 Dec 14 Announced €2.30 9 Jan 15 Second approach €2.4 26 Jan New approach €2.55 24 Feb Aer Lingus expected results 27 Feb IAG expected results H1 2015 Expected completion Aer Lingus without prior agreement from IAG tells today of their third approach from IAG. The potential offer said IAG is €2.50 in cash and a dividend of €0.05. Preconditions to include confirmatory due diligence, the recommendation of the Board of Aer Lingus and the receipt of irrevocable commitments from Ryanair and the Minister for Finance of Ireland to accept the offer. Deal overview and trading commentary At this level better sellers Problem is politics not Ryanair The upside is clouded by potential political intervention, which means deal is unlikely to trade tight. If the deal is confirmed at current terms, we assume the politics keep the deal trading on implied 75% probability of success, a t current share price, we are better sellers Ryanair owns sufficient stock to block major restructuring and disposals thus the reason they have been forced by the Commission to sell the stake. (Ryanair is appealing). In our view Ryanair is a happy seller at this offer level. Ryanair’s whole stake was acquired at a cost of €407.2m (according to submissions to the Commission). The €2.55 cash offer would make Ryanair whole. If Ryanair does not accept, the risk is that eventually a divestiture trustee in charge of selling the stake (as per the Commission ruling) forces the disposal and bring less money to Ryanair. Further, the cash offer (while not as high as the €2.80 offered by Ryanair in 2006) is at a 25% premium to the value of Aer Lingus’ Heathrow slots plus cash after the IASS contribution. The problem could be politics. Ireland’s general election is next year. Already Fianna Fáil is calling the stake “strategic national interest” and wants a rejection of the deal. Unions may intervene as 1000 jobs could be lost says FF. Aer Lingus has been widely expected to merge. Without IAG, any stock bid premium could dissipate.

Aer Lingus Takeover Page 15 Page 17

Aer Lingus Takeover Page 15 Page 17