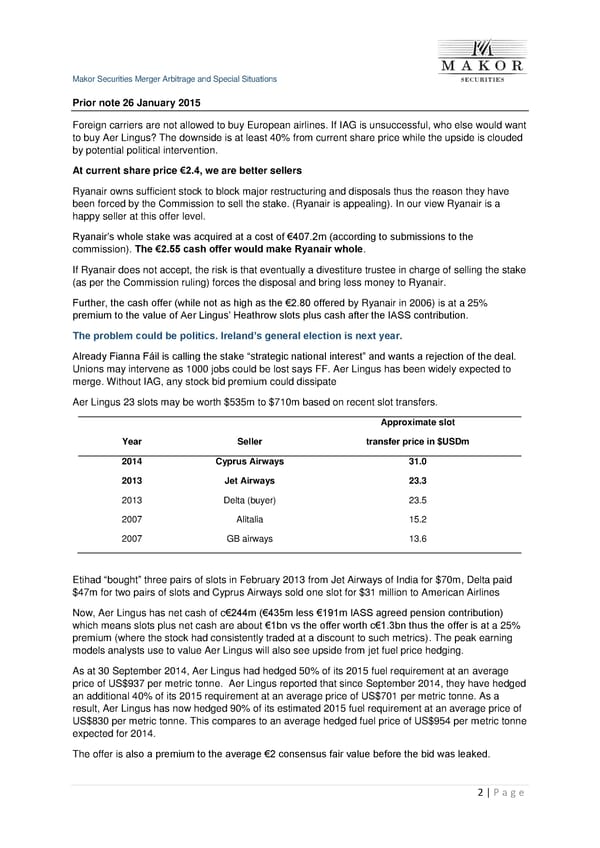

Makor Securities Merger Arbitrage and Special Situations 2 | P a g e Prior note 26 January 2015 Foreign carriers are not allowed to buy European airlines. If IAG is unsuccessful, who else would want to buy Aer Lingus? The downside is at least 40% from current share price while the upside is clouded by potential political intervention. At current share price €2.4, we are better sellers Ryanair owns sufficient stock to block major restructuring and disposals thus the reason they have been forced by the Commission to sell the stake. (Ryanair is appealing). In our view Ryanair is a happy seller at this offer level. Ryanair’s whole stake was acquired at a cost of €407.2m (according to submissions to the commission). The €2.55 cash offer would make Ryanair whole. If Ryanair does not accept, the risk is that eventually a divestiture trustee in charge of selling the stake (as per the Commission ruling) forces the disposal and bring less money to Ryanair. Further, the cash offer (while not as high as the €2.80 offered by Ryanair in 2006) is at a 25% premium to the value of Aer Lingus’ Heathrow slots plus cash after the IASS contribution. The problem could be politics. Ireland’s general election is next year. Already Fianna Fáil is calling the stake “strategic national interest” and wants a rejection of the deal. Unions may intervene as 1000 jobs could be lost says FF. Aer Lingus has been widely expected to merge. Without IAG, any stock bid premium could dissipate Aer Lingus 23 slots may be worth $535m to $710m based on recent slot transfers. Year Seller Approximate slot transfer price in $USDm 2014 Cyprus Airways 31.0 2013 Jet Airways 23.3 2013 Delta (buyer) 23.5 2007 Alitalia 15.2 2007 GB airways 13.6 Etihad “bought” three pairs of slots in February 2013 from Jet Airways of India for $70m, Delta paid $47m for two pairs of slots and Cyprus Airways sold one slot for $31 million to American Airlines Now, Aer Lingus has net cash of c€244m (€435m less €191m IASS agreed pension contribution) which means slots plus net cash are about €1bn vs the offer worth c€1.3bn thus the offer is at a 25% premium (where the stock had consistently traded at a discount to such metrics). The peak earning models analysts use to value Aer Lingus will also see upside from jet fuel price hedging. As at 30 September 2014, Aer Lingus had hedged 50% of its 2015 fuel requirement at an average price of US$937 per metric tonne. Aer Lingus reported that since September 2014, they have hedged an additional 40% of its 2015 requirement at an average price of US$701 per metric tonne. As a result, Aer Lingus has now hedged 90% of its estimated 2015 fuel requirement at an average price of US$830 per metric tonne. This compares to an average hedged fuel price of US$954 per metric tonne expected for 2014. The offer is also a premium to the average €2 consensus fair value before the bid was leaked.

Aer Lingus Takeover Page 9 Page 11

Aer Lingus Takeover Page 9 Page 11