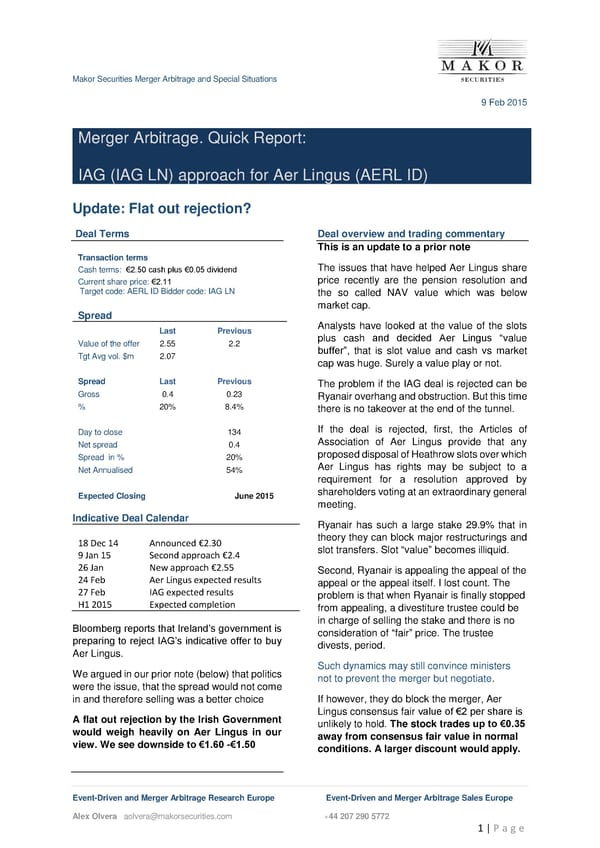

Makor Securities Merger Arbitrage and Special Situations Event-Driven and Merger Arbitrage Research Europe Event-Driven and Merger Arbitrage Sales Europe Alex Olvera [email protected] +44 207 290 5772 1 | P a g e 9 Feb 2015 Merger Arbitrage. Quick Report: IAG (IAG LN) approach for Aer Lingus (AERL ID) Update: Flat out rejection? Deal Terms Transaction terms Cash terms: €2.50 cash plus €0.05 dividend Current share price: €2.11 Target code: AERL ID Bidder code: IAG LN Spread Last Previous Value of the offer 2.55 2.2 Tgt Avg vol. $m 2.07 Spread Last Previous Gross 0.4 0.23 % 20% 8.4% Day to close 134 Net spread 0.4 Spread in % 20% Net Annualised 54% Expected Closing June 2015 Indicative Deal Calendar 18 Dec 14 Announced €2.30 9 Jan 15 Second approach €2.4 26 Jan New approach €2.55 24 Feb Aer Lingus expected results 27 Feb IAG expected results H1 2015 Expected completion Bloomberg reports that Ireland’s government is preparing to reject IAG’s indicative offer to buy Aer Lingus. We argued in our prior note (below) that politics were the issue, that the spread would not come in and therefore selling was a better choice A flat out rejection by the Irish Government would weigh heavily on Aer Lingus in our view. We see downside to €1.60 -€1.50 Deal overview and trading commentary This is an update to a prior note The issues that have helped Aer Lingus share price recently are the pension resolution and the so called NAV value which was below market cap. Analysts have looked at the value of the slots plus cash and decided Aer Lingus “value buffer”, that is slot value and cash vs market cap was huge. Surely a value play or not. The problem if the IAG deal is rejected can be Ryanair overhang and obstruction. But this time there is no takeover at the end of the tunnel. If the deal is rejected, first, the Articles of Association of Aer Lingus provide that any proposed disposal of Heathrow slots over which Aer Lingus has rights may be subject to a requirement for a resolution approved by shareholders voting at an extraordinary general meeting. Ryanair has such a large stake 29.9% that in theory they can block major restructurings and slot transfers. Slot “value” becomes illiquid. Second, Ryanair is appealing the appeal of the appeal or the appeal itself. I lost count. The problem is that when Ryanair is finally stopped from appealing, a divestiture trustee could be in charge of selling the stake and there is no consideration of “fair” price. The trustee divests, period. Such dynamics may still convince ministers not to prevent the merger but negotiate. If however, they do block the merger, Aer Lingus consensus fair value of €2 per share is unlikely to hold. The stock trades up to €0.35 away from consensus fair value in normal conditions. A larger discount would apply.

Aer Lingus Takeover Page 8 Page 10

Aer Lingus Takeover Page 8 Page 10