Sapiens (SPNS: US) - 1Q16 Results

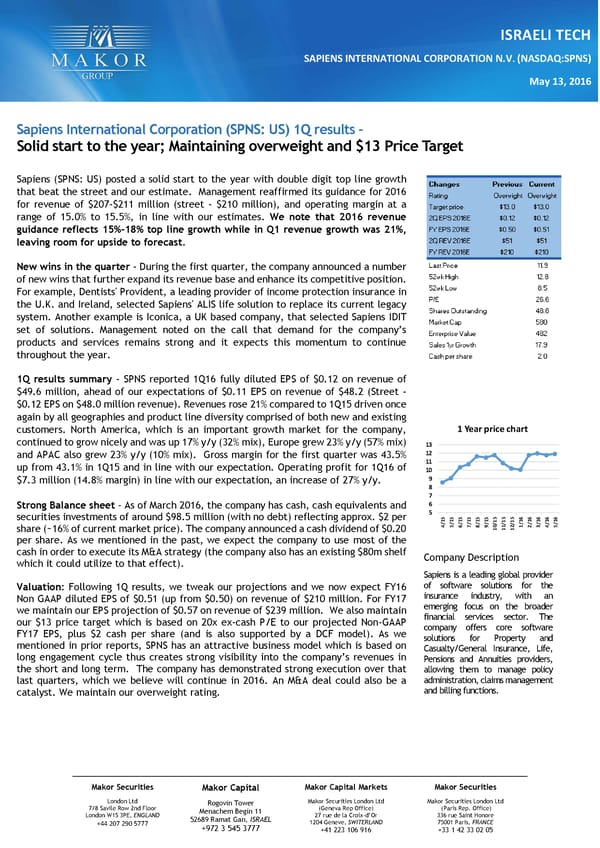

Makor Securities Makor Securities London Ltd (Paris Rep. Office) 336 rue Saint Honore 75001 Paris, FRANCE +33 1 42 33 02 05 Makor Capital Markets Makor Securities London Ltd (Geneva Rep Office) 27 rue de la Croix-d’Or 1204 Geneve, SWITERLAND +41 223 106 916 Makor Capital Rogovin Tower Menachem Begin 11 52689 Ramat Gan, ISRAEL +972 3 545 3777 Makor Securities London Ltd 7/8 Savile Row 2nd Floor London W1S 3PE, ENGLAND +44 207 290 5777 ISRAELI TECH SAPIENS INTERNATIONAL CORPORATION N.V. (NASDAQ:SPNS) May 13, 2016 Sapiens International Corporation (SPNS: US) 1Q results – Solid start to the year; Maintaining overweight and $13 Price Target Sapiens (SPNS: US) posted a solid start to the year with double digit top line growth that beat the street and our estimate. Management reaffirmed its guidance for 2016 for revenue of $207-$211 million (street - $210 million), and operating margin at a range of 15.0% to 15.5%, in line with our estimates. We note that 2016 revenue guidance reflects 15%-18% top line growth while in Q1 revenue growth was 21%, leaving room for upside to forecast. New wins in the quarter - During the first quarter, the company announced a number of new wins that further expand its revenue base and enhance its competitive position. For example, Dentists' Provident, a leading provider of income protection insurance in the U.K. and Ireland, selected Sapiens' ALIS life solution to replace its current legacy system. Another example is Iconica, a UK based company, that selected Sapiens IDIT set of solutions. Management noted on the call that demand for the company’s products and services remains strong and it expects this momentum to continue throughout the year. 1Q results summary - SPNS reported 1Q16 fully diluted EPS of $0.12 on revenue of $49.6 million, ahead of our expectations of $0.11 EPS on revenue of $48.2 (Street - $0.12 EPS on $48.0 million revenue). Revenues rose 21% compared to 1Q15 driven once again by all geographies and product line diversity comprised of both new and existing customers. North America, which is an important growth market for the company, continued to grow nicely and was up 17% y/y (32% mix), Europe grew 23% y/y (57% mix) and APAC also grew 23% y/y (10% mix). Gross margin for the first quarter was 43.5% up from 43.1% in 1Q15 and in line with our expectation. Operating profit for 1Q16 of $7.3 million (14.8% margin) in line with our expectation, an increase of 27% y/y. Strong Balance sheet – As of March 2016, the company has cash, cash equivalents and securities investments of around $98.5 million (with no debt) reflecting approx. $2 per share (~16% of current market price). The company announced a cash dividend of $0.20 per share. As we mentioned in the past, we expect the company to use most of the cash in order to execute its M&A strategy (the company also has an existing $80m shelf which it could utilize to that effect). Valuation: Following 1Q results, we tweak our projections and we now expect FY16 Non GAAP diluted EPS of $0.51 (up from $0.50) on revenue of $210 million. For FY17 we maintain our EPS projection of $0.57 on revenue of $239 million. We also maintain our $13 price target which is based on 20x ex-cash P/E to our projected Non-GAAP FY17 EPS, plus $2 cash per share (and is also supported by a DCF model). As we mentioned in prior reports, SPNS has an attractive business model which is based on long engagement cycle thus creates strong visibility into the company’s revenues in the short and long term. The company has demonstrated strong execution over that last quarters, which we believe will continue in 2016. An M&A deal could also be a catalyst. We maintain our overweight rating. Company Description Sapiens is a leading global provider of software solutions for the insurance industry, with an emerging focus on the broader financial services sector. The company offers core software solutions for Property and Casualty/General Insurance, Life, Pensions and Annuities providers, allowing them to manage policy administration, claims management and billing functions. 5 6 7 8 9 10 11 12 13 4/155/156/157/158/159/1510/1511/1512/151/162/163/164/165/16 1 Year price chart

Sapiens (SPNS: US) - 1Q16 Results Page 2

Sapiens (SPNS: US) - 1Q16 Results Page 2