Nova Measuring Instruments (NVMI: US) 1Q results

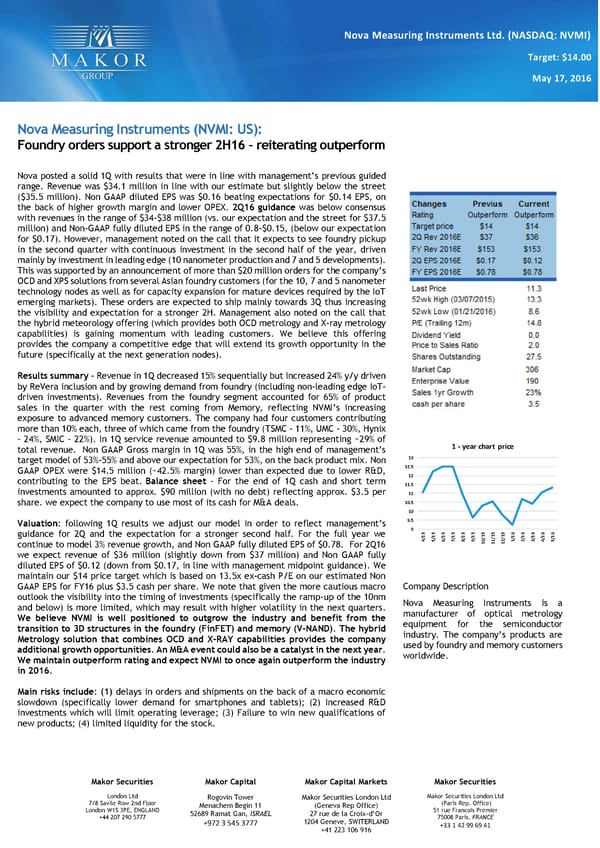

Nova Measuring Instruments Ltd. (NASDAQ: NVMI) Target: $14.00 May 17, 2016 Nova Measuring Instruments (NVMI: US): Foundry orders support a stronger 2H16 – reiterating outperform Nova posted a solid 1Q with results that were in line with management’s previous guided range. Revenue was $34.1 million in line with our estimate but slightly below the street ($35.5 million). Non GAAP diluted EPS was $0.16 beating expectations for $0.14 EPS, on the back of higher growth margin and lower OPEX. 2Q16 guidance was below consensus with revenues in the range of $34-$38 million (vs. our expectation and the street for $37.5 million) and Non-GAAP fully diluted EPS in the range of 0.8-$0.15, (below our expectation for $0.17). However, management noted on the call that it expects to see foundry pickup in the second quarter with continuous investment in the second half of the year, driven mainly by investment in leading edge (10 nanometer production and 7 and 5 developments). This was supported by an announcement of more than $20 million orders for the company’s OCD and XPS solutions from several Asian foundry customers (for the 10, 7 and 5 nanometer technology nodes as well as for capacity expansion for mature devices required by the IoT emerging markets). These orders are expected to ship mainly towards 3Q thus increasing the visibility and expectation for a stronger 2H. Management also noted on the call that the hybrid meteorology offering (which provides both OCD metrology and X-ray metrology capabilities) is gaining momentum with leading customers. We believe this offering provides the company a competitive edge that will extend its growth opportunity in the future (specifically at the next generation nodes). Results summary - Revenue in 1Q decreased 15% sequentially but increased 24% y/y driven by ReVera inclusion and by growing demand from foundry (including non-leading edge IoT- driven investments). Revenues from the foundry segment accounted for 65% of product sales in the quarter with the rest coming from Memory, reflecting NVMI’s increasing exposure to advanced memory customers. The company had four customers contributing more than 10% each, three of which came from the foundry (TSMC - 11%, UMC - 30%, Hynix – 24%, SMIC – 22%). In 1Q service revenue amounted to $9.8 million representing ~29% of 1 - year chart price total revenue. Non GAAP Gross margin in 1Q was 55%, in the high end of management’s 13 target model of 53%-55% and above our expectation for 53%, on the back product mix. Non GAAP OPEX were $14.5 million (~42.5% margin) lower than expected due to lower R&D, 12.5 contributing to the EPS beat. Balance sheet – For the end of 1Q cash and short term 12 investments amounted to approx. $90 million (with no debt) reflecting approx. $3.5 per 11.5 11 share. we expect the company to use most of its cash for M&A deals. 10.5 10 Valuation: following 1Q results we adjust our model in order to reflect management’s 9.5 guidance for 2Q and the expectation for a stronger second half. For the full year we 9 5 5 5 5 5 5 5 5 5 6 6 6 6 6 14/5/16/17/18/19/10/11/12/11/12/13/14/15/1 continue to model 3% revenue growth, and Non GAAP fully diluted EPS of $0.78. For 2Q16 1 1 1 we expect revenue of $36 million (slightly down from $37 million) and Non GAAP fully diluted EPS of $0.12 (down from $0.17, in line with management midpoint guidance). We maintain our $14 price target which is based on 13.5x ex-cash P/E on our estimated Non GAAP EPS for FY16 plus $3.5 cash per share. We note that given the more cautious macro Company Description outlook the visibility into the timing of investments (specifically the ramp-up of the 10nm Nova Measuring Instruments is a and below) is more limited, which may result with higher volatility in the next quarters. manufacturer of optical metrology We believe NVMI is well positioned to outgrow the industry and benefit from the equipment for the semiconductor transition to 3D structures in the foundry (FinFET) and memory (V-NAND). The hybrid Metrology solution that combines OCD and X-RAY capabilities provides the company industry. The company’s products are additional growth opportunities. An M&A event could also be a catalyst in the next year. used by foundry and memory customers We maintain outperform rating and expect NVMI to once again outperform the industry worldwide. in 2016. Main risks include: (1) delays in orders and shipments on the back of a macro economic slowdown (specifically lower demand for smartphones and tablets); (2) Increased R&D investments which will limit operating leverage; (3) Failure to win new qualifications of new products; (4) limited liquidity for the stock. Makor Securities Makor Capital Makor Capital Markets Makor Securities London Ltd Rogovin Tower Makor Securities London Ltd Makor Securities London Ltd 7/8 Savile Row 2nd Floor Menachem Begin 11 (Geneva Rep Office) (Paris Rep. Office) London W1S 3PE, ENGLAND 52689 Ramat Gan, ISRAEL 27 rue de la Croix-d’Or 51 rue Francois Premier +44 207 290 5777 +972 3 545 3777 1204 Geneve, SWITERLAND 75008 Paris, FRANCE +41 223 106 916 +33 1 42 99 69 41

Nova Measuring Instruments (NVMI: US) 1Q results Page 2

Nova Measuring Instruments (NVMI: US) 1Q results Page 2