Mellanox Technologies - 1Q16 Results

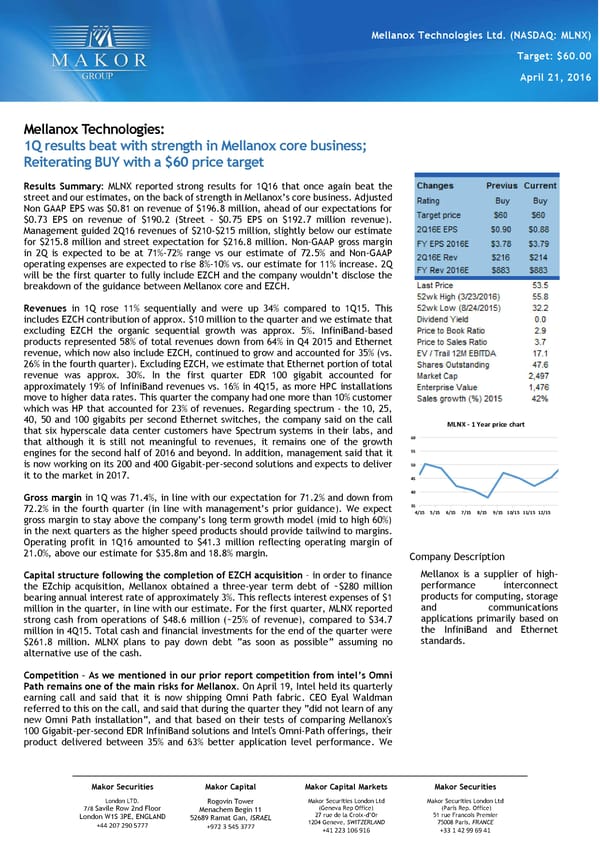

Mellanox Technologies Ltd. (NASDAQ: MLNX) Target: $60.00 April 21, 2016 Mellanox Technologies: 1Q results beat with strength in Mellanox core business; Reiterating BUY with a $60 price target Results Summary: MLNX reported strong results for 1Q16 that once again beat the street and our estimates, on the back of strength in Mellanox’s core business. Adjusted Non GAAP EPS was $0.81 on revenue of $196.8 million, ahead of our expectations for $0.73 EPS on revenue of $190.2 (Street - $0.75 EPS on $192.7 million revenue). Management guided 2Q16 revenues of $210-$215 million, slightly below our estimate for $215.8 million and street expectation for $216.8 million. Non-GAAP gross margin in 2Q is expected to be at 71%-72% range vs our estimate of 72.5% and Non-GAAP operating expenses are expected to rise 8%-10% vs. our estimate for 11% increase. 2Q will be the first quarter to fully include EZCH and the company wouldn’t disclose the breakdown of the guidance between Mellanox core and EZCH. Revenues in 1Q rose 11% sequentially and were up 34% compared to 1Q15. This includes EZCH contribution of approx. $10 million to the quarter and we estimate that excluding EZCH the organic sequential growth was approx. 5%. InfiniBand-based products represented 58% of total revenues down from 64% in Q4 2015 and Ethernet revenue, which now also include EZCH, continued to grow and accounted for 35% (vs. 26% in the fourth quarter). Excluding EZCH, we estimate that Ethernet portion of total revenue was approx. 30%. In the first quarter EDR 100 gigabit accounted for approximately 19% of InfiniBand revenues vs. 16% in 4Q15, as more HPC installations move to higher data rates. This quarter the company had one more than 10% customer which was HP that accounted for 23% of revenues. Regarding spectrum - the 10, 25, 40, 50 and 100 gigabits per second Ethernet switches, the company said on the call MLNX - 1 Year price chart that six hyperscale data center customers have Spectrum systems in their labs, and that although it is still not meaningful to revenues, it remains one of the growth 60 engines for the second half of 2016 and beyond. In addition, management said that it 55 is now working on its 200 and 400 Gigabit-per-second solutions and expects to deliver 50 it to the market in 2017. 45 Gross margin in 1Q was 71.4%, in line with our expectation for 71.2% and down from 40 72.2% in the fourth quarter (in line with management’s prior guidance). We expect 35 4/15 5/15 6/15 7/15 8/15 9/15 10/15 11/15 12/15 gross margin to stay above the company’s long term growth model (mid to high 60%) in the next quarters as the higher speed products should provide tailwind to margins. Operating profit in 1Q16 amounted to $41.3 million reflecting operating margin of 21.0%, above our estimate for $35.8m and 18.8% margin. Company Description Capital structure following the completion of EZCH acquisition – in order to finance Mellanox is a supplier of high- the EZchip acquisition, Mellanox obtained a three-year term debt of ~$280 million performance interconnect bearing annual interest rate of approximately 3%. This reflects interest expenses of $1 products for computing, storage million in the quarter, in line with our estimate. For the first quarter, MLNX reported and communications strong cash from operations of $48.6 million (~25% of revenue), compared to $34.7 applications primarily based on million in 4Q15. Total cash and financial investments for the end of the quarter were the InfiniBand and Ethernet $261.8 million. MLNX plans to pay down debt ”as soon as possible” assuming no standards. alternative use of the cash. Competition – As we mentioned in our prior report competition from intel’s Omni Path remains one of the main risks for Mellanox. On April 19, Intel held its quarterly earning call and said that it is now shipping Omni Path fabric. CEO Eyal Waldman referred to this on the call, and said that during the quarter they ”did not learn of any new Omni Path installation”, and that based on their tests of comparing Mellanox's 100 Gigabit-per-second EDR InfiniBand solutions and Intel's Omni-Path offerings, their product delivered between 35% and 63% better application level performance. We Makor Securities Makor Capital Makor Capital Markets Makor Securities London LTD. Rogovin Tower Makor Securities London Ltd Makor Securities London Ltd 7/8 Savile Row 2nd Floor Menachem Begin 11 (Geneva Rep Office) (Paris Rep. Office) London W1S 3PE, ENGLAND 52689 Ramat Gan, ISRAEL 27 rue de la Croix-d’Or 51 rue Francois Premier +44 207 290 5777 +972 3 545 3777 1204 Geneve, SWITZERLAND 75008 Paris, FRANCE +41 223 106 916 +33 1 42 99 69 41

Mellanox Technologies - 1Q16 Results Page 2

Mellanox Technologies - 1Q16 Results Page 2