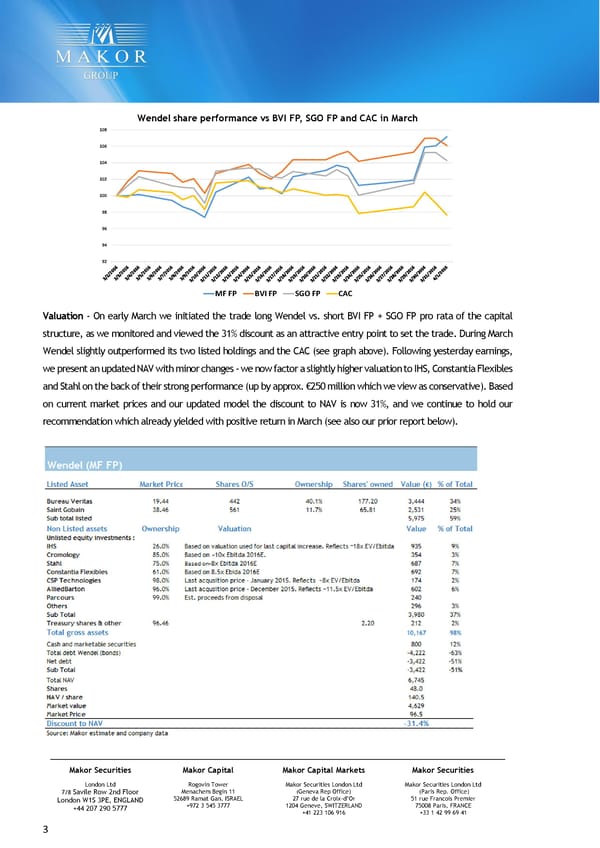

MAKOR FLASH-LIGHT Aug 12, 2015 Wendel share performance vs BVI FP, SGO FP and CAC in March 108 106 104 102 100 98 96 94 92 MF FP BVI FP SGO FP CAC Valuation - On early March we initiated the trade long Wendel vs. short BVI FP + SGO FP pro rata of the capital structure, as we monitored and viewed the 31% discount as an attractive entry point to set the trade. During March Wendel slightly outperformed its two listed holdings and the CAC (see graph above). Following yesterday earnings, we present an updated NAV with minor changes - we now factor a slightly higher valuation to IHS, Constantia Flexibles and Stahl on the back of their strong performance (up by approx. €250 million which we view as conservative). Based on current market prices and our updated model the discount to NAV is now 31%, and we continue to hold our recommendation which already yielded with positive return in March (see also our prior report below). Makor Securities Makor Capital Makor Capital Markets Makor Securities London Ltd Rogovin Tower Makor Securities London Ltd Makor Securities London Ltd 7/8 Savile Row 2nd Floor Menachem Begin 11 (Geneva Rep Office) (Paris Rep. Office) London W1S 3PE, ENGLAND 52689 Ramat Gan, ISRAEL 27 rue de la Croix-d’Or 51 rue Francois Premier +44 207 290 5777 +972 3 545 3777 1204 Geneve, SWITZERLAND 75008 Paris, FRANCE +41 223 106 916 +33 1 42 99 69 41 3

Long MF FP & Short BVI FP+SGO FP Page 2 Page 4

Long MF FP & Short BVI FP+SGO FP Page 2 Page 4