Long (CSTE: US) & Short (XHB: US)

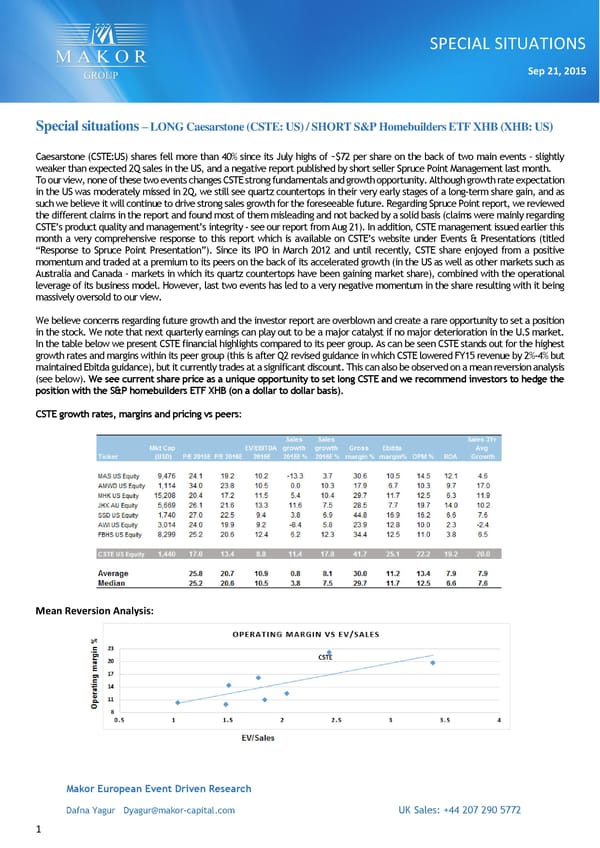

SPECIAL SITUATIONS Sep 21, 2015 Special situations – LONG Caesarstone (CSTE: US) / SHORT S&P Homebuilders ETF XHB (XHB: US) Caesarstone (CSTE:US) shares fell more than 40% since its July highs of ~$72 per share on the back of two main events – slightly weaker than expected 2Q sales in the US, and a negative report published by short seller Spruce Point Management last month. To our view, none of these two events changes CSTE strong fundamentals and growth opportunity. Although growth rate expectation in the US was moderately missed in 2Q, we still see quartz countertops in their very early stages of a long-term share gain, and as such we believe it will continue to drive strong sales growth for the foreseeable future. Regarding Spruce Point report, we reviewed the different claims in the report and found most of them misleading and not backed by a solid basis (claims were mainly regarding CSTE’s product quality and management’s integrity - see our report from Aug 21). In addition, CSTE management issued earlier this month a very comprehensive response to this report which is available on CSTE’s website under Events & Presentations (titled “Response to Spruce Point Presentation”). Since its IPO in March 2012 and until recently, CSTE share enjoyed from a positive momentum and traded at a premium to its peers on the back of its accelerated growth (in the US as well as other markets such as Australia and Canada – markets in which its quartz countertops have been gaining market share), combined with the operational leverage of its business model. However, last two events has led to a very negative momentum in the share resulting with it being massively oversold to our view. We believe concerns regarding future growth and the investor report are overblown and create a rare opportunity to set a position in the stock. We note that next quarterly earnings can play out to be a major catalyst if no major deterioration in the U.S market. In the table below we present CSTE financial highlights compared to its peer group. As can be seen CSTE stands out for the highest growth rates and margins within its peer group (this is after Q2 revised guidance in which CSTE lowered FY15 revenue by 2%-4% but maintained Ebitda guidance), but it currently trades at a significant discount. This can also be observed on a mean reversion analysis (see below). We see current share price as a unique opportunity to set long CSTE and we recommend investors to hedge the position with the S&P homebuilders ETF XHB (on a dollar to dollar basis). CSTE growth rates, margins and pricing vs peers: Mean Reversion Analysis: Makor European Event Driven Research Dafna Yagur [email protected] UK Sales: +44 207 290 5772 1

Long (CSTE: US) & Short (XHB: US) Page 2

Long (CSTE: US) & Short (XHB: US) Page 2