Gameloft (GFT FP)

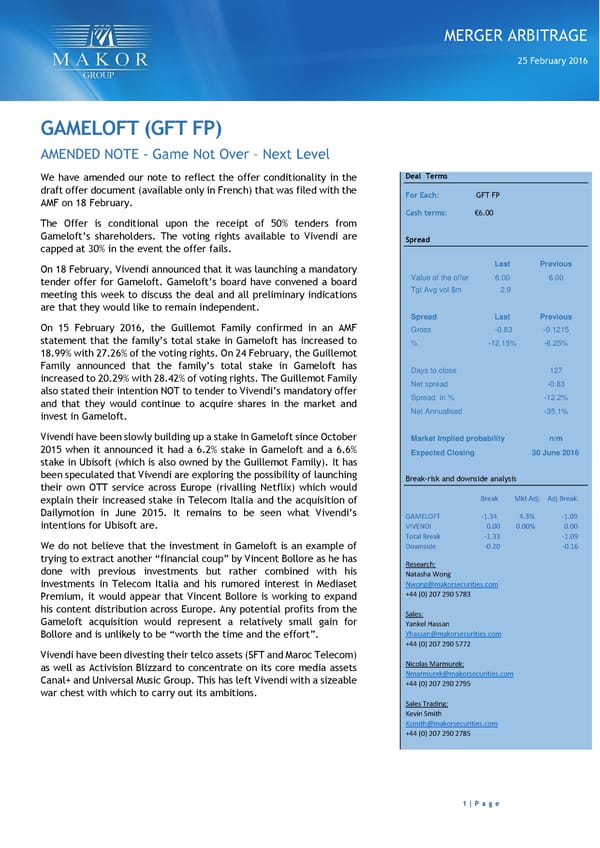

MERGER ARBITRAGE 25 February 2016 GAMELOFT (GFT FP) AMENDED NOTE - Game Not Over – Next Level We have amended our note to reflect the offer conditionality in the Deal Terms draft offer document (available only in French) that was filed with the For Each: GFT FP AMF on 18 February. Cash terms: €6.00 The Offer is conditional upon the receipt of 50% tenders from Gameloft’s shareholders. The voting rights available to Vivendi are Spread capped at 30% in the event the offer fails. On 18 February, Vivendi announced that it was launching a mandatory Last Previous Value of the offer 6.00 6.00 tender offer for Gameloft. Gameloft’s board have convened a board Tgt Avg vol $m 2.9 meeting this week to discuss the deal and all preliminary indications are that they would like to remain independent. Spread Last Previous On 15 February 2016, the Guillemot Family confirmed in an AMF Gross -0.83 -0.1215 statement that the family’s total stake in Gameloft has increased to % -12.15% -6.25% 18.99% with 27.26% of the voting rights. On 24 February, the Guillemot Family announced that the family’s total stake in Gameloft has Days to close 127 increased to 20.29% with 28.42% of voting rights. The Guillemot Family Net spread -0.83 also stated their intention NOT to tender to Vivendi’s mandatory offer Spread in % -12.2% and that they would continue to acquire shares in the market and Net Annualised -35.1% invest in Gameloft. Vivendi have been slowly building up a stake in Gameloft since October Market Implied probability n/m 2015 when it announced it had a 6.2% stake in Gameloft and a 6.6% Expected Closing 30 June 2016 stake in Ubisoft (which is also owned by the Guillemot Family). It has been speculated that Vivendi are exploring the possibility of launching Break-risk and downside analysis their own OTT service across Europe (rivalling Netflix) which would explain their increased stake in Telecom Italia and the acquisition of Break Mkt Adj. Adj Break. Dailymotion in June 2015. It remains to be seen what Vivendi’s GAMELOFT -1.34 4.3% -1.09 intentions for Ubisoft are. VIVENDI 0.00 0.00% 0.00 Total Break -1.33 -1.09 We do not believe that the investment in Gameloft is an example of Downside -0.20 -0.16 trying to extract another “financial coup” by Vincent Bollore as he has Research: done with previous investments but rather combined with his Natasha Wong investments in Telecom Italia and his rumored interest in Mediaset [email protected] Premium, it would appear that Vincent Bollore is working to expand +44 (0) 207 290 5783 his content distribution across Europe. Any potential profits from the Gameloft acquisition would represent a relatively small gain for Sales: Yankel Hassan Bollore and is unlikely to be “worth the time and the effort”. [email protected] +44 (0) 207 290 5772 Vivendi have been divesting their telco assets (SFT and Maroc Telecom) as well as Activision Blizzard to concentrate on its core media assets Nicolas Marmurek: Canal+ and Universal Music Group. This has left Vivendi with a sizeable [email protected] +44 (0) 207 290 2795 war chest with which to carry out its ambitions. Sales Trading: Kevin Smith [email protected] +44 (0) 207 290 2785 1 | P a g e

Gameloft (GFT FP) Page 2

Gameloft (GFT FP) Page 2