European Event Driven: Weekly Catch-up (6 July - 11 July 2015)

European Event Driven Last week in Europe Weekly Catch-up (6 July to 11 July 2015) The following companies could see corporate activity as mentioned in the press last week. Axel Springer Rolls Royce In addition we covered updates and news on ENOC/ Dragon oil Holcim/ Lafarge Sabadell/TSB Shell/BG Keysight/Anite And we organised a new corporate access group meeting ALSTOM GE/Alstom EC phase 2 analysis and perspectives Date: 23 July Group lunch Meeting, Mayfair london Browns hotel @12.30 UK time RSVP Full catch-up below 1 | P a g e Event-Driven Research Europe Alex Olvera aolvera@makorsecurities.com

Announced Deal Spreads EUROPE TERMS Spread Spread Expected Closing TARGET BIDDER Shares Cash % Annualized ANITE PLC KEYSIGHT TECHNOLOGIES IN 0 126.00 0.00% 0.00% 31 October 2015 ALCATEL-LUCENT NOKIA OYJ 0.55 0.00 2.49% 3.18% 15 April 2016 ANSALDO STS SPA HITACHI LTD 0 9.65 2.39% 5.10% 31 December 2015 BG GROUP PLC ROYAL DUTCH SHELL PLC-B SHS 0.4454 383.00 9.7% 12.47% 15 April 2016 CSR PLC QUALCOMM INC 0 900.00 2.74% 20.83% 30 August 2015 DELHAIZE GROUP KONINKLIJKE AHOLD NV 4.75 0.00 5.81% 5.31% 15 June 2016 DELHAIZE GROUP KONINKLIJKE AHOLD NV 5.073 0.00 12.99% 2.31% 15 June 2016 DRAGON OIL PLC ENOC 0 750.00 3.09% 14.29% 30 September 2015 NORBERT DENTRESSANGLE XPO LOGISTICS INC 0 217.50 -0.02% -4.19% 15 July 2015 EURASIA DRILLIN-GDR REGS SCHLUMBERGER LTD 0 22.00 29.56% nm 15 September 2015 JAZZTEL PLC ORANGE 0 13.00 0.08% 0.87% 25 July 2015 PACE PLC ARRIS GROUP INC 0.1455 132.50 13.97% 29.94% 31 December 2015 PLUS500 LTD PLAYTECH PLC 0 400.00 2.56% 11.85% 30 September 2015 PIRELLI & C. CHEMCHINA 0 15.00 -1.70% -3.64% 31 December 2015 REXAM PLC BALL CORP 0.04568 407.00 8.98% 8.87% 15 June 2016 SYNERGY HEALTH PLC STERIS CORP 0.4308 439.00 28.28% nm 30 June 2015 TNT EXPRESS NV FEDEX CORP 0 8.00 3.53% 5.24% 15 March 2016 WORLD DUTY FREE SPA DUFRY AG-REG 0 10.25 0.69% 3.69% 15 September 2015 Last week our PDF notes We wrote on Dragon Oil’s upside CVR (PDF on request) Official rejections to the deal now account for at least 10.3pct, which means that ENOC is now more likely to need a bump to convince the large minorities to accept the offer or risk failing again. We estimated the upside value of a potential CVR bump. Our simple calculation may mean that Baillie Gifford wants a CVR bump of 50p per Cheleken second field and since there are at least four fields, the total CVR value could be 150p. The share price upside to the 750p offer in case a CVR is agreed could be at least 50p.The offer is schedule for its first close 30 July 2015. The offer period likely will be extended. The document indicates however that the offer must be declared unconditional to acceptances no later than 3pm on the 30 August 2015. (This is day 60).Unless extended, ENOC has until day 46 or 16 August to amend its offer. 2 | P a g e Event-Driven Research Europe Alex Olvera aolvera@makorsecurities.com

We updated the completion timetable on Holcim/Lafarge (PDF on request) At least 81.47 percent of the voting rights1 of Lafarge S.A. have been tendered to the Offer. The success of the Offer was subject to the condition that a minimum acceptance threshold of 2/3 of Lafarge’s share capital or voting rights be reached by Holcim Ltd The offer will be automatically re-opened within ten trading days following the publication of the final results of the Offer. The AMF will publish a timetable for the Re-opened Offer, but we understand Holcim expects to re-open the offer July 15th The re-opened offer must be open for at least ten trading days. From our conversations with the companies we understand the second close may be 28 July and publications of results within nine trading days. After settlement to the second close, Holcim can pay the script dividend. Such scrip dividend shall be in the ratio of one new LafargeHolcim Share for twenty existing LafargeHolcim Shares. Companies mentioned it is expected by 10 August 2015. Expected Re-opening Calendar 03 July 2015 First close to the offer 09 July 2015 Publish Final results to the offer 10 July 2015 Holcim expected to launch capital increase 14 July Expected settlement 15 July 2015 Re-open 28 July 2015 Second close to the offer 03 August 2015 Expected results to the re-opened offer. (Within 9 trading days after closing) 9 August 2015 Expected settlement to reopened offer 10 August 2015 Script dividend expected 3 | P a g e Event-Driven Research Europe Alex Olvera aolvera@makorsecurities.com

We closed our file on Sabadell/TSB (PDF on request) Sabadell announced they have received valid acceptances to their offer for TSB in excess of 90% and declare the offer fully unconditional. They further announce that a section 979 notice will go out to minorities. This means Sabadell is now legally bound to acquire the 10% not owned. The offer is still open to acceptances but TSB will stop trading /delist 28 July. We assume this is the date from which 979 notices are sent and Sabadell has 6 weeks to start the squeeze-out which should complete within 3 months. We close our file. We wrote on BG/Shell. Brazil approves. First pre condition cleared Australia next (PDF on request) The Brazilian antitrust authority CADE, has cleared the proposed acquisition of BG by Shell without restrictions. (See here) CADE approval is a pre-condition and is positive for the spread of the deal. In approving the deal without restrictions, Petrobras said that “the LNG market is global in scope, because the product is delivered by ship over long distances, and there are several countries that actively participate in this market… thus mitigates any possibility of market power exercise by the applicants as a result of this operation”. The comments are perhaps relevant in the context of the next catalyst. Australia ACCC review. The ACCC stopped taking comments today. The ACCC is expected to rule on the deal 3 September 2015. The review in Australia could look at the overlap of assets in Queensland. Shell holds a 50% interest in Arrow Energy, a joint venture with PetroChina (CNPC). BG has an interest in an LNG plant on Curtis Island (QCLNG Project) with China National Offshore Oil Corporation (CNOOC) and Tokyo Gas. The ACCC may look at complaints that there is a shortage of gas in Queensland and that allowing the deal could lead to higher prices for Australian gas users. The ACCC review may be significant also for China’s companies CNPC/CNOOC and therefore for Mofcom. The ACCC may be looking at preserving prices and supply into Australia while Mofcom may look at issues around exporting gas and maybe the stakes held by CNPC/CNOOC. We wrote on Anite. Earlier completion expected and Korea approval received. (PDF on request) Keysight released the scheme document this week. We learned that one of the key conditions to deal completion has been received.On July 1st, Keysight received notification from Korea Fair Trade Commission that the Acquisition does not violate Article 7, Paragraph 1 of the Monopoly Regulation and Fair Trade Law. For this reason perhaps, Keysight has brought forward the completion date by two months. Keysight expects completion by the end August 2015 (before they said October).The pending key condition now is voting approval at the General & Court Meeting that will take place 30 July 2015. 4 | P a g e Event-Driven Research Europe Alex Olvera aolvera@makorsecurities.com

Corporate access Alstom GE/Alstom EC phase 2 analysis and perspectives Date: 23 July Group lunch Meeting, Mayfair london Browns hotel @12.30 UK time Topic: GE /Alstom EC approval? Guest: Alstom 13 year veteran with particular knowledge of Gas Turbine markets. Our guest career in the power industry spans twenty years, in particular in the field of gas-fired turbines. Among several positions at Alstom over 13 years he worked in Alstom’s gas turbine R&D division, he was Head of the product management and marketing team focusing on the entire Alstom Gas Turbine portfolio. During his career, he has acquired unique Gas Turbines comprehensive knowledge, ranging from the operational issues, development history, costs, market shares, competition and customers issues. Background to the presentation: The European commission opened an in-depth investigation into the GE acquisition of Alstom in February, warning it could lead to higher prices for heavy- duty gas turbines. The merger would reduce the number of suppliers of such turbines in Europe from four to two. Higher Prices , less choice and less inovation is the key worry if the EC allows the merger. The EC sent GE a statement of objections last month. GE has requested a hearing with the EC for this next Thursday. The EC has a provisional deadline to respond by 21 August. We want to understand why and how GE/Alston could resolve the worries customers and the EC have. The EC review is only about the heavy-duty gas turbines market. This is a very specific topic to analyse . Our guest has the necessary combination of engineering expertise and commercial knowledge to navigate us trough the issues and potential solutions RSVP There will be a dial-in facility for non UK clients 20 phone lines only 5 | P a g e Event-Driven Research Europe Alex Olvera aolvera@makorsecurities.com

New firm deals this week None Closed deals this week Sabadell for TSB Announced approach/approvals this week BWIN.PARTY The Board of bwin.party confirms that it has received a proposal from GVC Holdings plc ('GVC') to acquire all of the outstanding and to be issued share capital of bwin.party at a price of 110 pence per bwin.party share, comprised of a combination of new GVC shares and cash. The Board has considered the GVC proposal, the potential benefits of which it believes can accrue to bwin.party shareholders from a combination of the two companies and the commitment shown to resolving a number of transaction-related issues, and has determined to work with GVC so that they can finalise their offer over the coming days. RYANAIR BOARD VOTES TO ACCEPT IAG OFFER FOR AER LINGUS STAKE The Board of Ryanair Holdings PLC today (10 July) confirmed that it has voted unanimously to accept the IAG offer for Ryanair's 29.8% shareholding in Aer Lingus Group plc. Ryanair's stake in Aer Lingus has been available for sale since May 2012 (see attached) and the Board believes that the current IAG offer maximises Ryanair shareholder value. In line with this decision, Ryanair will now vote in favour of the motion at the Aer Lingus EGM on the 16 July next (to give the Irish Government a golden share over Aer Lingus's Heathrow slots) and Ryanair will also vote its 29.8% shareholding in favour of acceptance of the IAG offer, subject to this offer receiving regulatory approval from the European competition authorities 6 | P a g e Event-Driven Research Europe Alex Olvera aolvera@makorsecurities.com

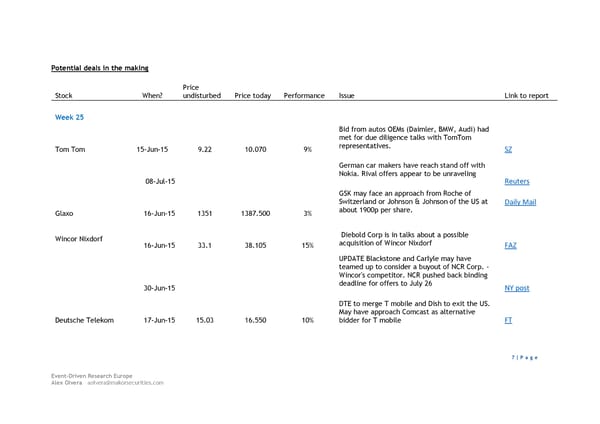

Potential deals in the making Price Stock When? undisturbed Price today Performance Issue Link to report Week 25 Bid from autos OEMs (Daimler, BMW, Audi) had met for due diligence talks with TomTom Tom Tom 15-Jun-15 9.22 10.070 9% representatives. SZ German car makers have reach stand off with Nokia. Rival offers appear to be unraveling 08-Jul-15 Reuters GSK may face an approach from Roche of Switzerland or Johnson & Johnson of the US at Daily Mail Glaxo 16-Jun-15 1351 1387.500 3% about 1900p per share. Wincor Nixdorf Diebold Corp is in talks about a possible 16-Jun-15 33.1 38.105 15% acquisition of Wincor Nixdorf FAZ UPDATE Blackstone and Carlyle may have teamed up to consider a buyout of NCR Corp. - Wincor's competitor. NCR pushed back binding 30-Jun-15 deadline for offers to July 26 NY post DTE to merge T mobile and Dish to exit the US. May have approach Comcast as alternative Deutsche Telekom 17-Jun-15 15.03 16.550 10% bidder for T mobile FT 7 | P a g e Event-Driven Research Europe Alex Olvera aolvera@makorsecurities.com

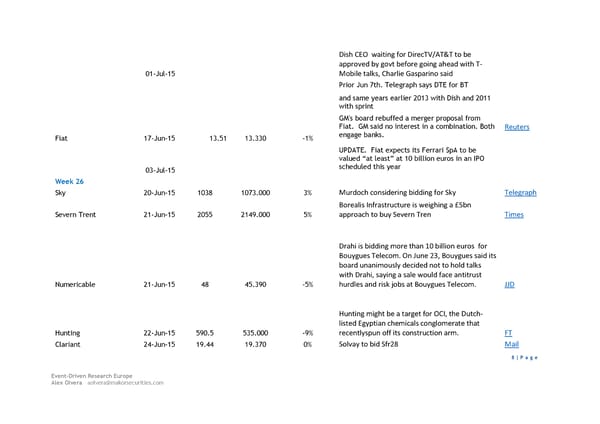

Dish CEO waiting for DirecTV/AT&T to be approved by govt before going ahead with T- 01-Jul-15 Mobile talks, Charlie Gasparino said Prior Jun 7th. Telegraph says DTE for BT and same years earlier 2013 with Dish and 2011 with sprint GM's board rebuffed a merger proposal from Fiat. GM said no interest in a combination. Both Reuters Fiat 17-Jun-15 13.51 13.330 -1% engage banks. UPDATE. Fiat expects its Ferrari SpA to be valued “at least” at 10 billion euros in an IPO 03-Jul-15 scheduled this year Week 26 Sky 20-Jun-15 1038 1073.000 3% Murdoch considering bidding for Sky Telegraph Borealis Infrastructure is weighing a £5bn Severn Trent 21-Jun-15 2055 2149.000 5% approach to buy Severn Tren Times Drahi is bidding more than 10 billion euros for Bouygues Telecom. On June 23, Bouygues said its board unanimously decided not to hold talks with Drahi, saying a sale would face antitrust Numericable 21-Jun-15 48 45.390 -5% hurdles and risk jobs at Bouygues Telecom. JJD Hunting might be a target for OCI, the Dutch- listed Egyptian chemicals conglomerate that Hunting 22-Jun-15 590.5 535.000 -9% recentlyspun off its construction arm. FT Clariant 24-Jun-15 19.44 19.370 0% Solvay to bid Sfr28 Mail 8 | P a g e Event-Driven Research Europe Alex Olvera aolvera@makorsecurities.com

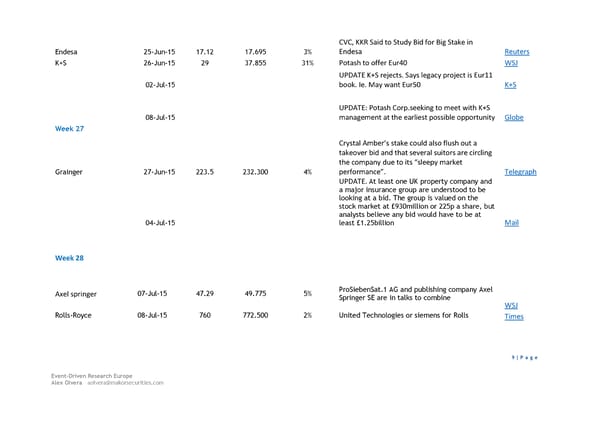

CVC, KKR Said to Study Bid for Big Stake in Endesa 25-Jun-15 17.12 17.695 3% Endesa Reuters K+S 26-Jun-15 29 37.855 31% Potash to offer Eur40 WSJ UPDATE K+S rejects. Says legacy project is Eur11 02-Jul-15 book. Ie. May want Eur50 K+S UPDATE: Potash Corp.seeking to meet with K+S 08-Jul-15 management at the earliest possible opportunity Globe Week 27 Crystal Amber’s stake could also flush out a takeover bid and that several suitors are circling the company due to its “sleepy market Grainger 27-Jun-15 223.5 232.300 4% performance”. Telegraph UPDATE. At least one UK property company and a major insurance group are understood to be looking at a bid. The group is valued on the stock market at £930million or 225p a share, but analysts believe any bid would have to be at 04-Jul-15 least £1.25billion Mail Week 28 Axel springer 07-Jul-15 47.29 49.775 5% ProSiebenSat.1 AG and publishing company Axel Springer SE are in talks to combine WSJ Rolls-Royce 08-Jul-15 760 772.500 2% United Technologies or siemens for Rolls Times 9 | P a g e Event-Driven Research Europe Alex Olvera aolvera@makorsecurities.com

Research Disclaimer This publication has been prepared by Makor Capital Limited (“Makor Capital”) and is intended for professional or qualified investors only. Makor Securities London Ltd (“Makor Securities”)is distributing this material to its clients who are Eligible Counterparties or Professional Clients under FCA Rules. It may also be disseminated to persons who are Investment Professionals within the meaning of the Financial Services and Markets Act 2000 (Financial Promotion Order 2005). In the United States Makor Capital only distributes this material to major US institutional investors (as that term is defined in Rule 15 a-6 of the Securities and Exchange Act of 1934) and to SEC registered broker-dealers or banks acting in a broker –dealer capacity” If you do not fall into any of these categories you should disregard it. This research material is a marketing communication. It is not investment research and has not been prepared in accordance with legal requirements designed to promote the independence of investment research. It is not subject to any prohibition on dealing ahead of the dissemination of investment research. It has not been produced by Makor Securities. This material does not take into account the particular investment objectives, financial situation or needs of individual clients or other recipients. Before acting on this material, clients and other recipients should consider whether it is suitable for their particular circumstances and, if necessary, seek professional advice. This material should not be construed in any circumstances as an offer to sell or solicitation of any offer to buy any security or other financial instrument, nor shall it, or the fact of its distribution, form the basis of, or be relied upon in connection with, any contract relating to such action. This material is produced by research providers which Makor Securities believes to be reliable, but Makor Securities does not warrant or represent (expressly or impliedly) that it is accurate, complete, not misleading or as to its fitness for the purpose intended and it should not be relied upon as such. Opinions expressed will be the current opinions of those producing the research as of the date appearing on this material only. We expect those producing the material in this report to update it on a timely basis but can give no undertaking that they will do so and regulatory compliance or other reasons may prevent them from doing so (or us from disseminating updated material). Members and employees of Makor Securities London Ltd, employees of Makor Capital, Makor Capital Markets may from time to time have long or short positions in securities, warrants, futures, options, derivatives or other financial instruments referred to in this material. For Makor Securities, this information is set out in our Conflicts of Interest Policy which is available on request. Policies for the production of research from other research providers are available on request. Unless otherwise stated, share prices provided within this material are as at the close of business on the day prior to the date of the material. Neither the whole nor any part of this material may be duplicated in any form or by any means. Neither should any of this material be redistributed or disclosed to anyone without prior consent. This material is issued for general information and discussion purposes only. None of Makor Securities, Makor Capital, Makor Capital Markets accepts liability whatsoever for any direct, indirect or consequential loss or damage of any kind arising out of the use of all or any of this material. The services, securities and investments discussed in this material may not be available to, nor are suitable for all investors. Investors should make their own investment decisions based upon their own financial objectives and financial resources and it should be noted that investment involves risk, including the risk of capital loss. Past performance is no guide to future performance. In relation to securities denominated in foreign currency, movements in exchange rates will have an effect on the value, either favourable or unfavourable. Entities Makor Securities London Ltd is authorised and regulated by the Financial Conduct Authority (FCA registration number 625054) of Dover House, 34 Dover Street, London W1S 4NG. Makor Capital, company number 514456466, is incorporated in Israel and is a 100% held subsidiary of Makor Holdings Pte Ltd incorporated in Singapore. Makor Capital Markets SA, company number CH-660.2.999.011-0 is incorporated in Switzerland and is also a 100% held subsidiary of Makor Holdings Pte Ltd. 10 | P a g e Event-Driven Research Europe Alex Olvera aolvera@makorsecurities.com